MT4 NDD No Commission

Best choice for trading on news

What is NDD technology?

NDD (No Dealing Desk) technology that is implemented on MT4 NDD accounts grants an opportunity to trade with prices from the largest liquidity providers for world electronic networks.

This technology may be interesting to those who prefer intraday trading (scalping), especially on news releases that increase the volatility of the market.

How it works

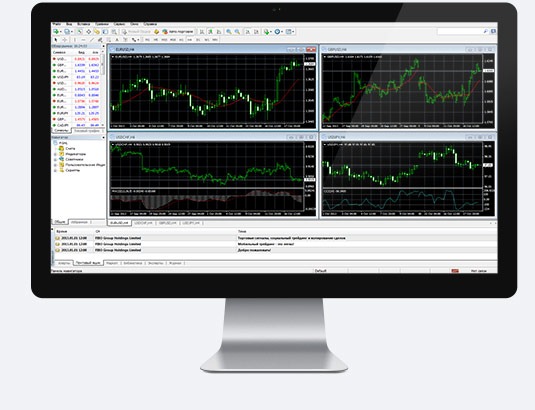

NDD technology trading is implemented on a trading platform that is familiar to traders from all over the world – Meta Trader 4.

Market orders are executed at the best market price of the liquidity providers once the order reaches the electronic trading system where it will be executed at the NDD-technology. Thus, it may slip between the price that you see in the terminal, and the price of execution. Moreover, such slippage can also be in your favor. Since the system can provide you with high liquidity, this slippage, under the normal conditions, either does not exist at all or is immaterial. Under low liquidity or explosive volatility conditions, the slippage is generally higher than on a quiet market.

NDD No Commission accounts features

-

Commission

On account type MT4 No Commission for opening and closing of positions commission won’t be charged.

-

Execution of Stop orders

Once the price reaches the stop order level in the MT4, a request for an order execution would be transmitted via the bridge to the trading system, where the order would be executed at the best market price of the liquidity providers at the moment the order reaches the system. Thus, in case of stop orders, as well as in case of execution of market order, slippage between the stop price and price of execution may occur. Moreover, slippage can also be in your favor. More information about the market execution features can be read above.

-

Margin requirements

If at any time «Equity» (current balance including open positions) becomes equal or less than 50 % of the margin held for the open positions, the dealer has the right on his own discretion to close any of the open positions in order to maintain margin requirements.

During weekends and public holidays the margin requirements may increase from 1 % to 3 % (i.e. the maximum leverage for this period would be 1:33).The client is obliged to bring his open positions in accordance with the increased margin requirements at least 30 minutes before the trading session closes (before bidding). -

Execution of Limit orders

Once the price reaches the limit order level in the MT4, a request for the order execution is transmitted via the bridge to the trading system. Also, please note that if you use a limit order facility, you will never get a price worse than the one that was stated in your order i.e, you will either get your order executed at the requested price or at the better price.

Contracts specifications

1 Maximum volume of a transaction expressed in lot.

2 The figures in columns represent the quantity of points charged to a customer’s open position if it is rolled over to the following day. These values are calculated based on differences between short-term interest rates. Since the value date is the second business day after a transaction is entered into, Monday next week is the value date for transactions entered on Wednesday. Accordingly, from Wednesday to Thursday swaps are charged in triple size.

3 Collateral for a lock position is calculated as follows: For example, we have an open buy position of 1.0 EUR/USD and a sell position of 1.0 EUR/USD; for this lock position (with leverage of 1 to 100) for МТ4 collateral will be 250 EUR + 250 EUR = 500 EUR.

4 In the period from 23:55 till 00:05 EET (bank rollover) liquidity is reducing, spread and processing time of customer orders may be increased.

Please note that our services are provided only to the residents of the following counties (in alphabetical order): Austria, Bulgaria, British Virgin Islands, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Kazakhstan, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Oman, People's Republic of China, Poland, Portugal, Romania, Russia, Slovakia,Slovenia, Spain, Sweden, Ukraine, United Arab Emirates.

Please feel free to contact out Support in order to get further assistance.